Transparency, Openness, and Our 2021-2022 Financials

Every year, as required by U.S. federal law for 501(c)(3) nonprofits, the Tor Project completes a Form 990, and as required by contractual obligations and state regulations, an independent audit of our financial statements. After completing standard audits for 2021-2022,* our federal tax filings (Form 990) and audited financial statements are both now available. We upload all of our tax documents and publish a blog post about these documents in order to be transparent.

Transparency for a privacy project is not a contradiction: privacy is about choice, and we choose to be transparent in order to build trust and a stronger community. In this post, we aim to be very clear about where the Tor Project's money comes from and what we do with it. This is how we operate in all aspects of our work: we show you all of our projects, in source code, and in periodic project and team reports, and in collaborations with researchers who help assess and improve Tor. Transparency also means being clear about our values, promises, and priorities as laid out in our social contract.

We hope that by expanding each subsection of this post and adding more detail, you will have an even better understanding of the Tor Project's funding, and that you will be able to read the audited financial statements and Form 990 on your own should you have more questions.

*Our fiscal years run from July through June instead of following the calendar year.

Fiscal Year 2021-2022 Summary

The audit and tax filing forms we discuss in this post cover July 1, 2021 to June 30, 2022. The end of the 2021-2022 fiscal year marked four years of our focused investment in increasing the Tor Project's fundraising capacity with new staff, new policies and procedures, and a renewed focus in diversifying our funding sources.

We're happy to say that we're seeing the results of this focus pay off---and we couldn't have done this without your support and belief in our vision. Below, we'll talk more about the details of the Revenue and Expenses throughout the 2021-2022 fiscal year.

Usually, we hope to post our transparency report earlier in the year. I apologize for the delay this year.

Revenue & Support

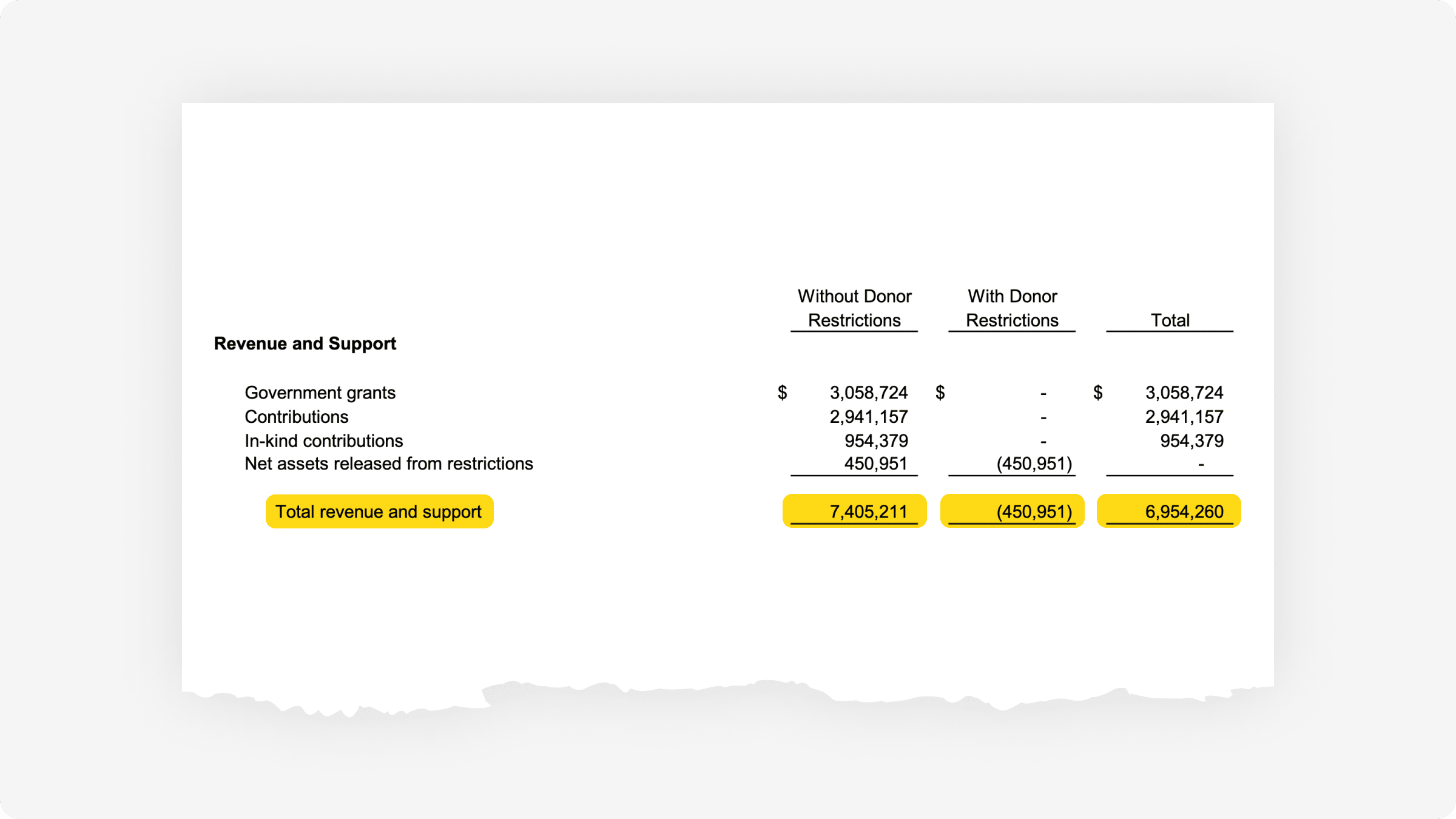

The Tor Project's Revenue and Support in fiscal year 2021-2022, as listed in the audited financial statement, was $6,954,260.

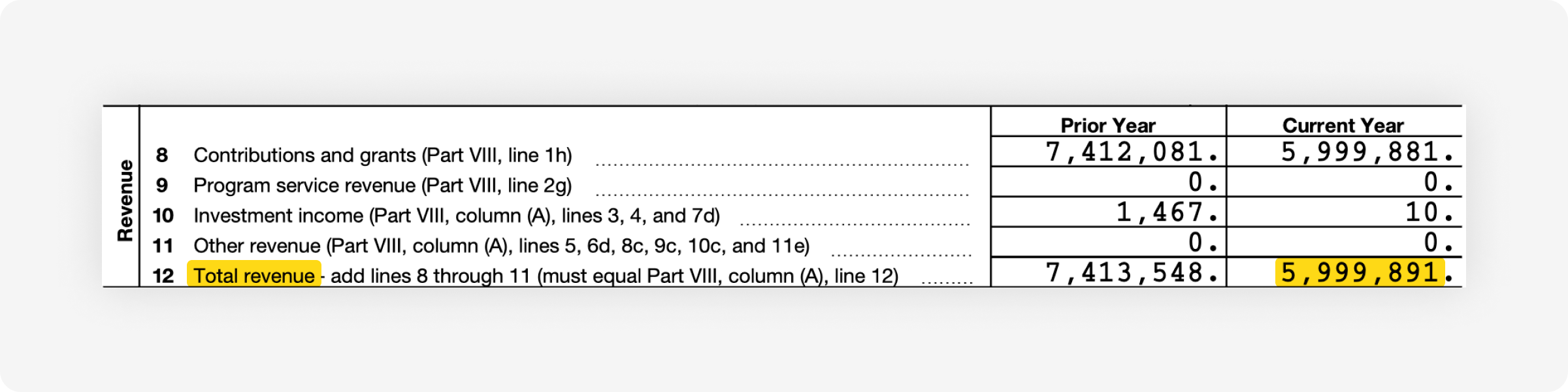

In our Form 990, our Revenue is listed as $5,999,891.

Why is the "revenue" category different on the Form 990 and the audited financials? This is not an error. The different revenue totals reflect differences in rules about how you must report tax revenue to the IRS and how you must report revenue in audited financial statements. The Tor Project's audited financial statements include in-kind contributions ($954,379) as a form of revenue, while the Form 990 includes the in-kind contributions as an expense.

A brief aside: let's talk about in-kind contributions----the value of which is included in the audited financial statements, and excluded in the Form 990----and how we derive that value. In-kind contributions are donated services or goods, like translations completed by volunteers, website hosting, donated hardware, and contributed patches. This year, we counted $954,379 in donated services: that's an estimated 7,614 hours of software development, 1,894,720 words translated, and cloud hosting services for 23 servers. Right now, this estimation does not include relay operator time and cost--but it should. We are working to better estimate both the hours of software development and how to represent the contributions made by relay operators. Stay tuned for the coming years! Clearly, Tor would not be possible without you. Thank you.

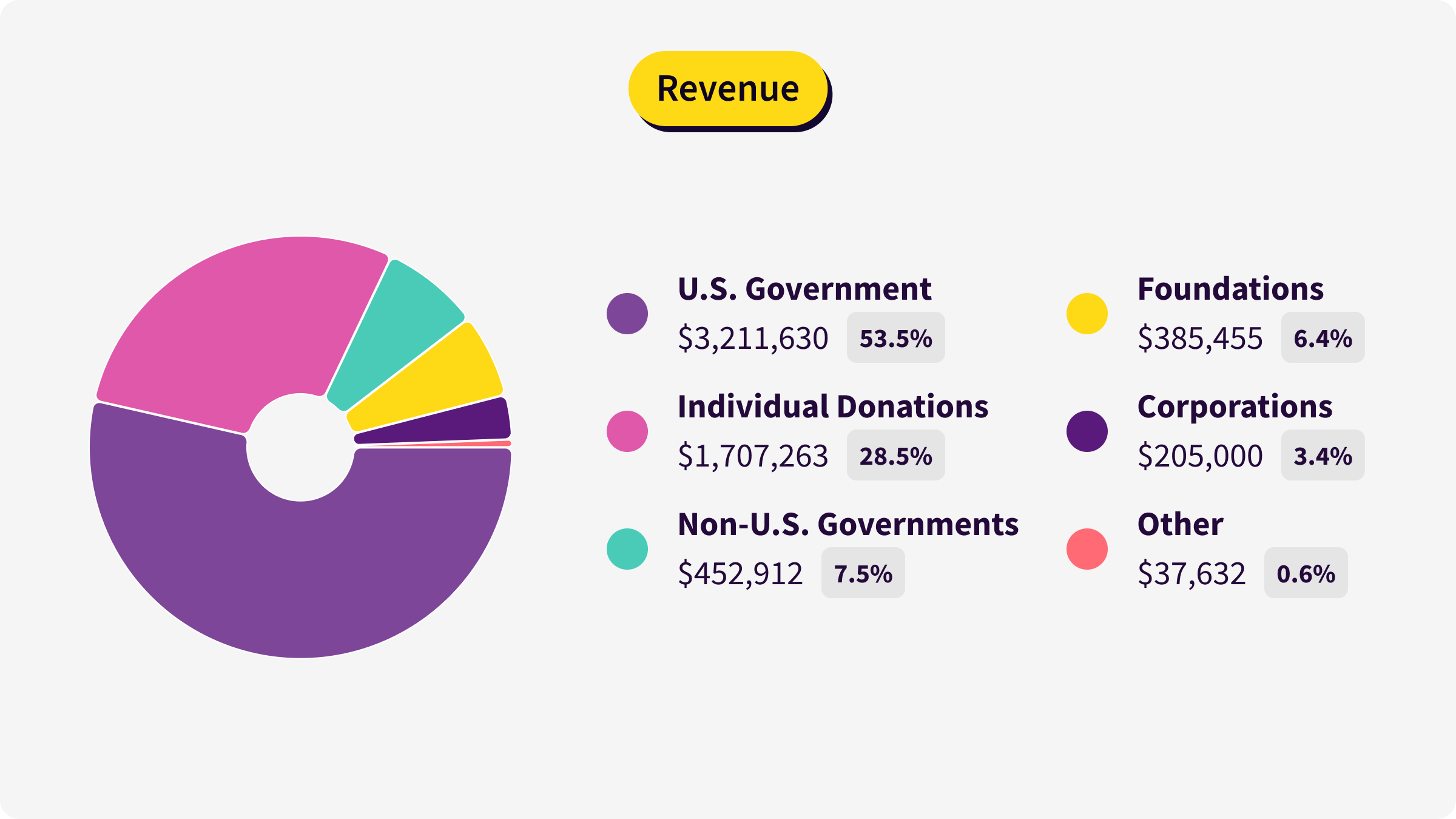

For the purposes of the following subsections of this blog post, we'll be looking at the Revenue total following the 990, and breaking this total into the following categories:

U.S. Government (53.5% of total revenue)

Individual Donations (28.5% of total revenue)

Non-U.S. Governments (7.5% of total revenue)

Foundations (6.4% of total revenue)

Corporations (3.4% of total revenue)

Other (0.6% of total revenue)

U.S. Government Support

During this fiscal year, about 53.5% of our revenue came from U.S. government funds. This is an increase from the previous fiscal year, but not necessarily an indicator that we're not achieving our long-term goal of diversifying our funding in order to rely less on one single source. It's important to remember that the timing of contracts and projects means this percentage fluctuates from year to year while still trending down over time.

We get a lot of questions (and see a lot of FUD) about how the U.S. government funds the Tor Project, so we want to make this as clear as possible and show you where to find this information in the future in these publicly-available documents.

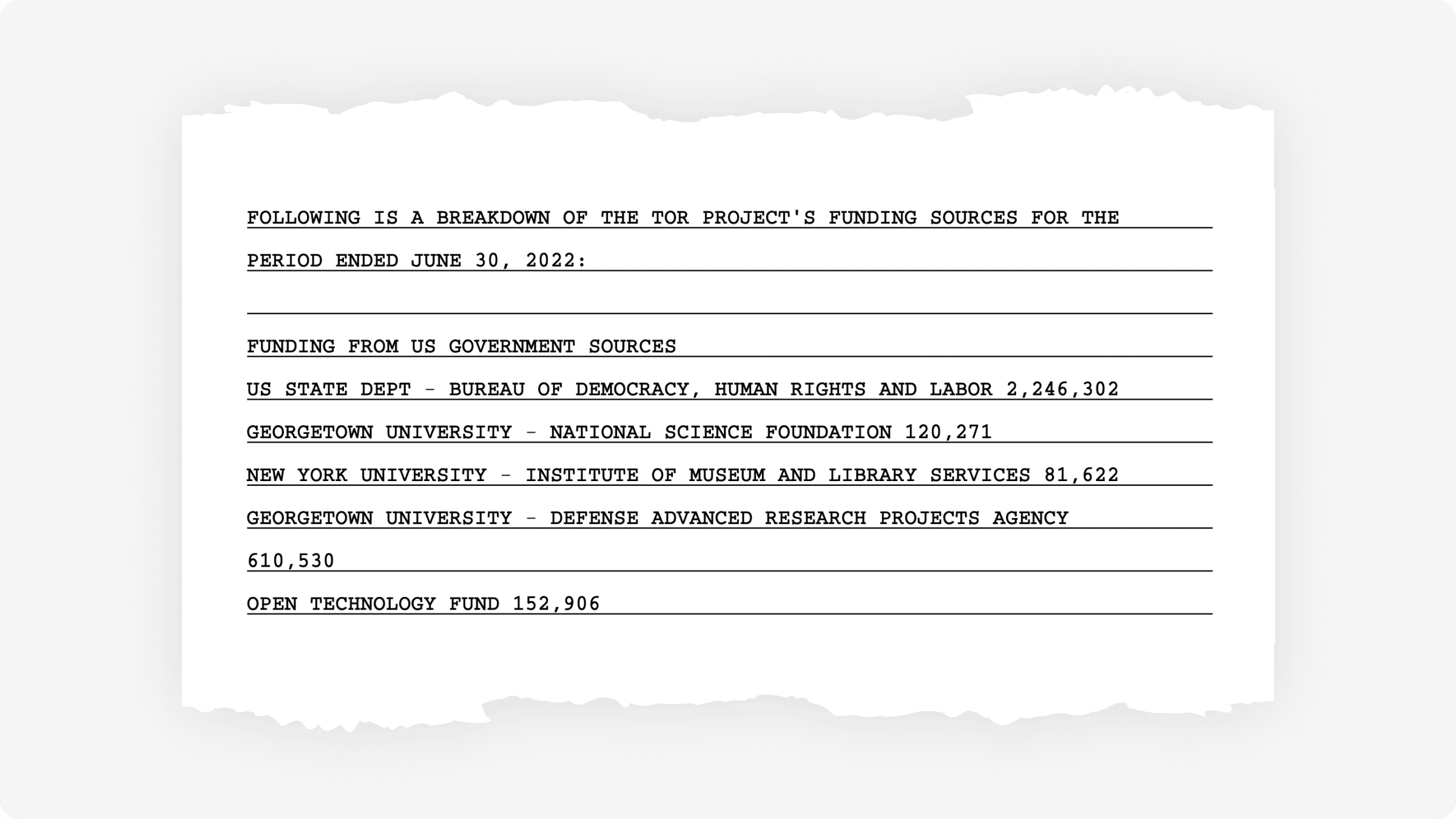

Let's talk specifically about which parts of the U.S. government support Tor, and what kind of projects they fund. Below, you can see a screenshot from the Tor Project's fiscal year 2021-2022 Form 990 on page 43, where we've listed all of our U.S. government funders. You will find text like this in our recent Form 990s:

Now, we'll break down which projects are funded by each entity and link you to places in GitLab where we organize the work associated with this funding.

U.S. State Department Bureau of Democracy, Human Rights, and Labor ($2,246,302)

Project: Empowering Communities in the Global South to Bypass Censorship

- Description: This project's goal was to empower human rights defenders in the Global South by improving censorship event detection and reporting, ensuring users have the best options for their needs to bypass censorship, and informing human rights defenders when censorship is happening and how to bypass it. Guardian Project and Tails were our subgrantees on this project. You can read our final public report on this project, our learnings, and next steps on our blog.

Project: Making the Tor network faster & more reliable for users in Internet-repressive places

- Description: This project's objectives were to streamline the tuning of the network; deploy smarter methods for balancing traffic; evaluate and implement promising performance and scalability research; and to proactively detect, diagnose, and resolve user-facing performance issues.

Some of this funding passed through the Tor Project to Open Observatory of Network Interference.

National Science Foundation + Georgetown University ($120,271)

-

- Description: This ongoing project's goal is to develop a scalable and mature deterministic network simulator, capable of quickly and accurately simulating large networks such as Tor. This project builds on the Shadow Simulator.

Institute of Museum and Library Science + New York University ($81,622)

- This funding passed through the Tor Project to Library Freedom Project to deliver the Library Freedom Institute.

Defense Advanced Research Projects Agency + Georgetown University ($610,530)

Project: Reliable Anonymous Communication Evading Censors and Repressors (RACECAR)

- Description: This project's goal was to understand how to obfuscate communication in the presence of an adversary that controls the entire network, by hiding all communications inside traffic generated by common applications.

Open Technology Fund ($152,906)

Project: Support users to circumvent censorship against USAGM media sites

- Description: The goal for this ongoing project is to get more onion services set up in the world. To complete this goal, we will develop tools to help with setup and monitoring of onion services as well as help different USAGM media services to set up and monitor their onion services. You can read about some of the outcomes of the first year of this project---an effort to plant and grow more onions---on our blog.

For even more about how government funding works for the Tor Project, consider reading our previous financial transparency posts, as well as Roger's thorough comments on these posts.

Individual Donations

The next largest category of contributions at 28.5% of the total revenue was individual donors. In the 2021-2022 fiscal year, supporters gave $1,707,263 to the Tor Project in the form of one-time gifts and monthly donations. These gifts came in all different forms (including ten different cryptocurrencies, which are then converted to USD).

Individual contributions come in many forms: some people donate $5 to the Tor Project one time, some donate $100 every month, and some make large gifts annually. The common thread is that individual donations are unrestricted funds, and a very important kind of support. Unrestricted funds allow us to respond to censorship events, develop our tools in a more agile way, and ensure we have reserves to keep Tor strong in case of emergencies.

Private Foundations + Corporations,

Of the revenue in fiscal year 2021-2022, about 6.4% came from foundations and other nonprofits, and then another 3.4% from corporations.

Some of these contributions are in the form of restricted grants, which means we pick a project that is on our roadmap, we propose it to a funder, they agree that this project is important, and we are funded to complete these projects. Some examples in this category include Zcash Community Grants' support of Arti and the Bertha Foundation's support for a fellow within the Tor Project who worked with environmental organizations and climate and Indigenous activists to strengthen their digital security.

Also in this category are unrestricted funds, like support from Alfred P. Sloan Foundation, Craig Newmark Philanthropies, and Ford Foundation. These unrestricted funds are not tied to a specific project.

Unrestricted funds also include contributions from corporations, and is where you will find membership dues from our members. In the 2021-2022 fiscal year, you'll see contributions from our members during this time. We haven't listed every single entity you will see in our Form 990 in this blog post, but we hope you have a better understanding of what you might find in the Form 990.

Non-U.S. Governments

This line item represents funding that comes from Sida, a government agency working on behalf of the Swedish parliament and government, with the mission to reduce poverty in the world. Sida supports the Tor Project so that we can carry out user research, localization, user support, usability improvements, training for communities, and training for trainers. This support is how we are able to meet our users and to carry out the user experience research we do to improve all Tor tools.

Other

$37,632 of our revenue is from and for the Privacy Enhancing Technologies Symposium. Tor supports the yearly PETS conference by providing structure and financial continuity.

Expenses

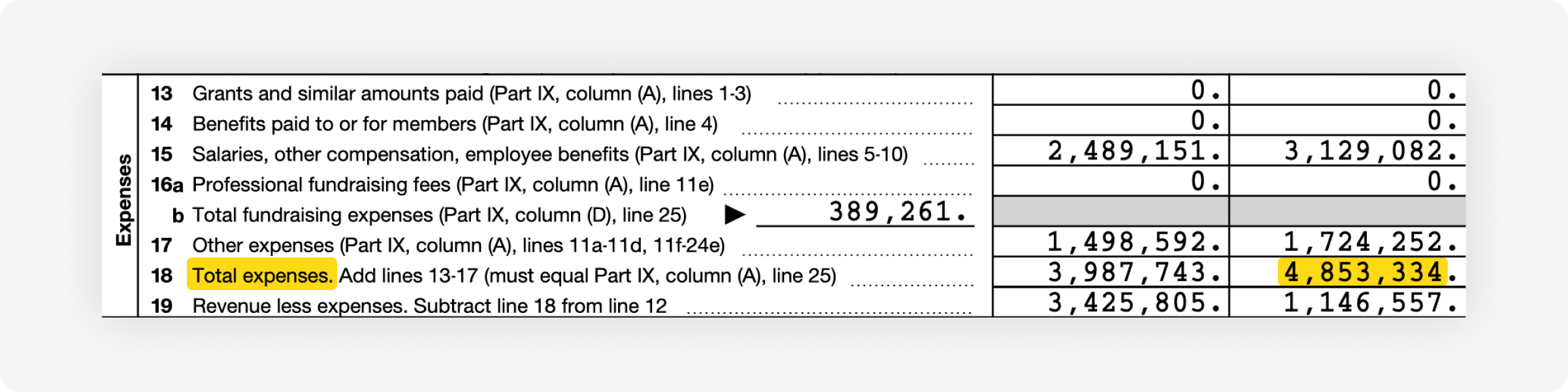

OK, we've told you how we get funding (and which documents to look at to learn more). Now what do we do with that money? Based on the Form 990, our expenses were $4,853,334 in fiscal year 2021-2022.

Like I discussed in the Revenue section above, the expenses listed in our Form 990 and audited financial statements are different. Based on the audited financial statements, our expenses (page 4) were $4,782,017.

Why the difference? The Form 990 does not include interest we've earned or the in-kind contributions--the audited financial statements does. For the rest of this blog post, as above, we'll be looking at the Expenses total following the Form 990.

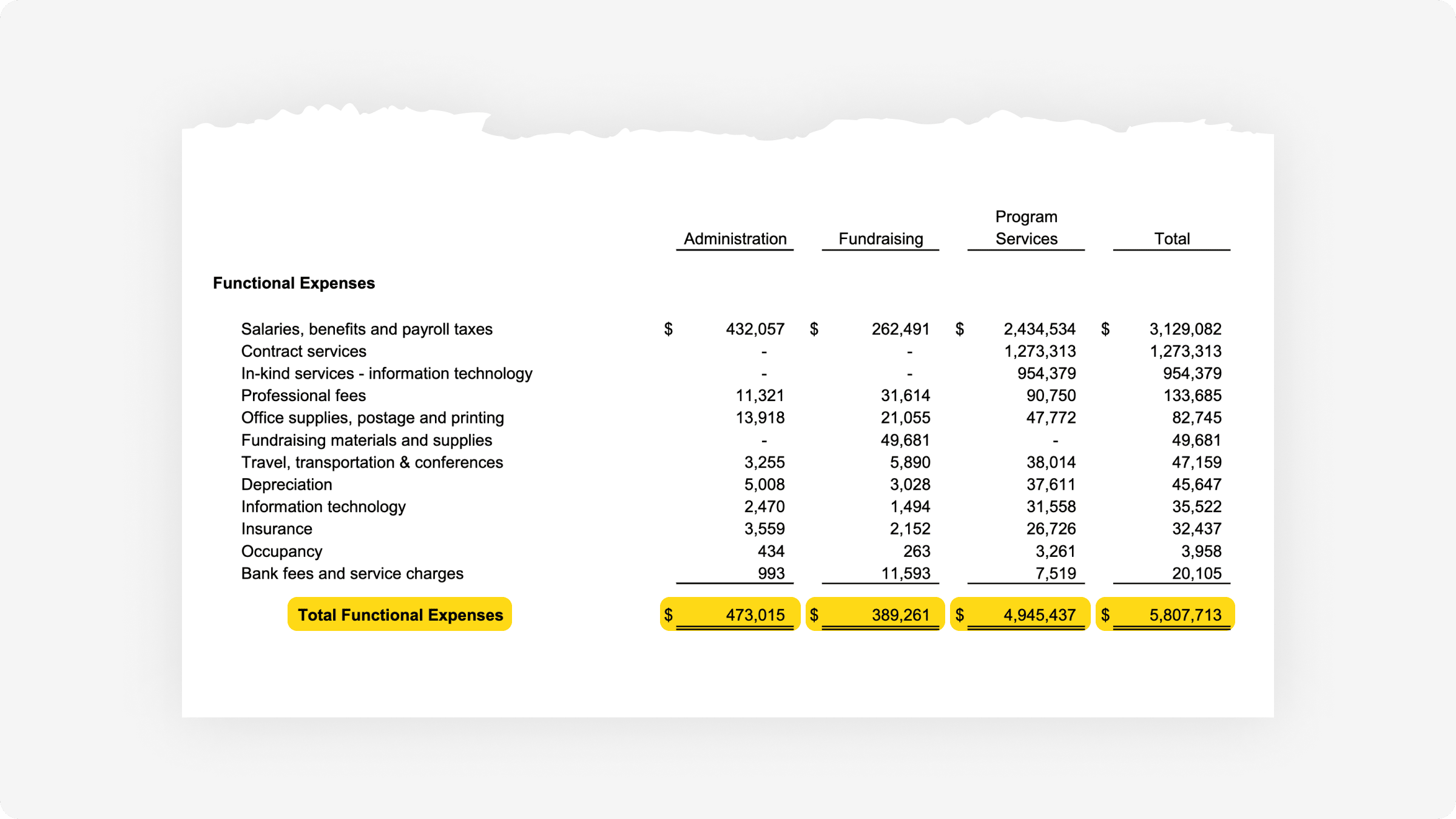

We break our expenses into three main categories:

Administration: costs associated with organizational administration, like salary for our Executive Director, office supplies, business insurance costs;

Fundraising: costs associated with the fundraising program, like salary for fundraising staff, tools we use for fundraising, bank fees, postal mail supplies, swag; and

Program services: costs associated with making and maintaining Tor and supporting the people who use it, including application, network, UX, metrics, and community staff salaries; contractor salaries; and IT costs. If you want to learn more about the work considered "program services," you should read our list of sponsored projects on our wiki.

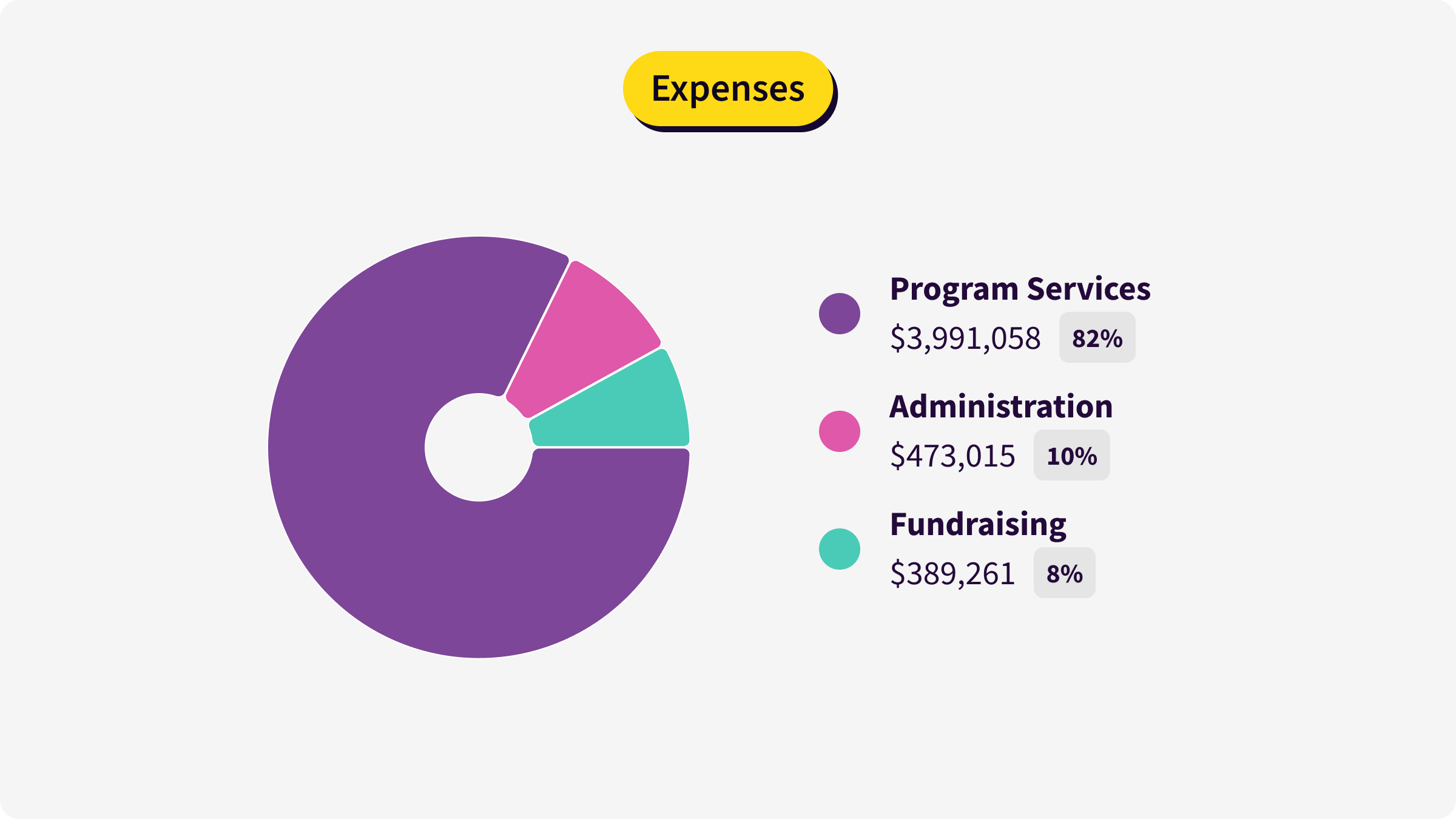

In the 2021-2022 fiscal year, 82% of our expenses were associated with program services. That means that a very significant portion of our budget goes directly into building Tor and making it better. Next comes administration at 10% and fundraising at 8%.

Ultimately, like Roger (the Tor Project's Co-Founder) has written in many past versions of this blog post, it's very important to remember the big picture: Tor's budget is modest considering our global impact. And it's also critical to remember that our annual revenue is utterly dwarfed by what our adversaries spend to suppress people's human right to privacy and anonymity, making the world a more dangerous and less free place.

In closing, we are extremely grateful for all of our donors and supporters. You make this work possible, and we hope this expanded version of our financial transparency post sheds more light on how the Tor Project raises money and how we spend it. Remember, that beyond making a donation, there are other ways to get involved, including volunteering and running a Tor relay!

Comments

We encourage respectful, on-topic comments. Comments that violate our Code of Conduct will be deleted. Off-topic comments may be deleted at the discretion of the moderators. Please do not comment as a way to receive support or to report bugs on a post unrelated to a release. If you are looking for support, please see our FAQ, user support forum or ways to get in touch with us.